Money is the lifeblood of a business irrespective of its size. A corporate needs money to finance its business. There are generally two types of funds in business- Equity and Debt. A company may resort to funding from many sources such as banks, public, venture capitals, internal reserves, foreign direct investment etc FDI in India is a major monetary source for economic development in India.

This article discuss about the private placement of securities and Foreign Direct Investment (FDI).

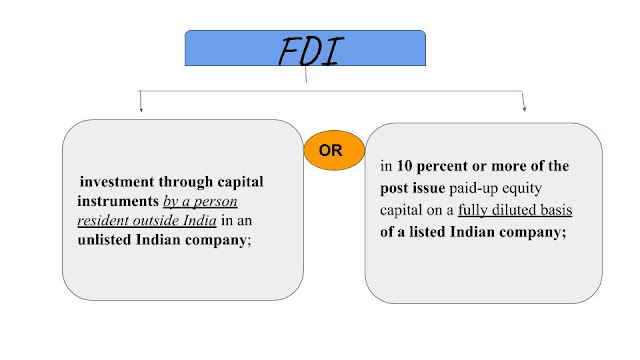

1 What is FDI?

Capital instruments means

- Equity shares,

- preference shares(Compulsorily convertible into equity)

- Bonds/debentures (Compulsorily convertible into equity)

- Share warrants (As per SEBI regulations

The Person resident outside India (PROI) must hold the capital instrument in an unlisted Indian Company for treating it as a FDI. Even a 1% holding in Unlisted Indian Company by PROI will be treated as FDI.

In listed companies, PROI holding less than 10% will be treated as Foreign Portfolio Investors(FPI) whereas holding more than or equal to 10% will be treated as FDI.

FDI is governed by Foreign Exchange Management Act, 1999 and Foreign Exchange Management (Transfer or Issue of Security by a Person Resident Outside India) Regulations, 2017

2 What is Private Placement?

Private placement means any offer or invitation to subscribe or issue of SECURITIES to a select group of persons by a company (other than by way of public offer, right issue or bonus) through private placement offer-cum-application.

Securities is a wider term which includes shares,scrips,bonds,debentures,convertible debentures etc.So any offer of securities to a select group of person is known as private placement.

Private placement is governed by Section 42 of Companies Act,2013 and Companies (Prospectus and Allotment of Securities)Rules,2014. Section 42 is applicable to each company3 What is SELECT GROUP OF PERSON and how to calculate it?

Select group of persons are the person who are identified by the board of directors for the offer of securities.Section 42(2) and Rule 14 prescribe the limit of 200 person in a Financial Year. A company can offer its securities to 200 person in a financial year.

The limit of 200 persons limit shall be reckoned individually for each kind of securities i.e. Equity, Debentures or Preference shares.

While Counting the limit of 200 persons, Qualified Institutions Buyers(QIBs) and Employees of the company offered securities under ESOP scheme shall be excluded. QIBs has been defined under SEBI(ICDR),2009 which includes Mutual Funds, Venture Capital Funds, Foreign Portfolio Investors, Public Financial institutions, Insurance Companies etc.

ANY OFFER OF SECURITIES WHICH BREACHES THE LIMIT OF 200 PERSONS OR NOT IN COMPLIANCE OF SECTION 42(2) SHALL BE TREATED AS DEEMED PUBLIC OFFER AND ALL THE PROVISIONS OF SEBI GUIDLENES WILL BECOME APPLICABLE TO IT.

Exemption of limit of 200 person is granted to NBFCs and Housing Finance Companies if they are complying with the regulations of RBI or National Housing Bank in respect of invitation or offer of securities to be offered on private placement basis.

4. Is FDI possible through Private Placement?

The board of directors of an Indian Company needs funding from outside india so they may approach PROI for investing in India. There is no restriction in Companies Act,2013 for taking funds from PROI. Hence BOD may offer securities to Foreign investors through private placement. Practically all startups who takes funds from PROI take the route of private placement.

5. Pricing Guidelines

6 Entry Routes of Foreign Investment

1. Approval Route: the entry route through which investment by a person resident outside India does not require the prior Reserve Bank approval or Government approval.Only Reporting is required.

2. Approval Route:the entry route through which investment by a person resident outside India requires prior Government approval.Application for approval shall be filed at Foreign investment Facilitation portal and approval shall be sought from concerned ministry.

PROCEDURE FOR FDI through PRIVATE PLACEMENT in UNLISTED INDIAN COMPANY under automatic route.

1. Indian entity which have received foreign investment must get themselves registered at Entity master. Entity master is a one stop portal for foreign investment reporting.The reporting under entity master will be under SINGLE MASTER FORM. Company needs to register at Foreign investment reporting management system(FIRMS)

2. Board resolution needs to be passed under section 179(3) for issue of securities to pre-identified person who are PROI and calling of General Meeting of Shareholders and BOD may delegate the authority of distributing offer letter and allotment to another person.

3. Both private and public company shall file E-form MGT-14 for Board approval under section 179(3)(c)

4. Call General meeting and pass Special resolution for issuing securities.

5. File e-form MGT-14 under section 117(3)(a) for SR.

6. The company shall maintain a complete record of private placement offers in Form PAS-5.

7. Send private placement offer cum application letter in FORM PAS-4 to identified person who are PROI within 30 days of recording the name of such person. Private placement offer and application shall not carry any right of renunciation.

8. Company shall open Seprate Bank Account in a scheduled bank account.

9.The company shall ensure that the amount of consideration shall be paid as inward remittance from abroad through banking channels or out of funds held in NRE/ FCNR(B)/ Escrow account maintained in accordance with the Foreign Exchange Management (Deposit) Regulations, 2016.

10. The company shall maintain the records of payment and shall ensure that the payment is received from the bank account of the identified person only.11. The company shall allot the securities within 60 days of receipt of money.

12.The company shall file Return of allotment in E-form PAS-3 within 15 days of allotment to ROC and File FORM FC-GPR on FIRMS portal for reporting FDI within 30 days of issue of Capital Instruments.

13.The company shall not utilise monies unless e-form PAS-3 is filed.

14.Indian company which has received FDI in the previous year(s) including the current year, should submit form FLA to the Reserve Bank on or before the 15th day of July of each year through email to: fla@rbi.org.in

ABOUT THE AUTHOR

Shivam Gera: Commerce Graduate from Satyawati College, University of Delhi and a Budding Company Secretary (All India Rank Holder)

Contact: LinkedIn Profile(CLICK HERE)

Contact: LinkedIn Profile(CLICK HERE)

Disclaimer: The entire contents of this document have been prepared on the basis of relevant provisions and as per the information existing at the time of the preparation. Although care has been taken to ensure the accuracy, completeness, and reliability of the information provided, I assume no responsibility, therefore. Users of this information are expected to refer to the relevant existing provisions of applicable Laws. The user of the information agrees that the information is not professional advice and is subject to change without notice. I assume no responsibility for the consequences of the use of such information.

This article is a property of lawthoro and no part of it shall be reproduced in any manner without our explicit permission.

We invite professionals or students who have a passion to write Legal Blogs. You can send your articles at lawthoro@gmail.com and it will be published after appraisal

Comments

Post a Comment